1. Main technology

Addition liquid silicone rubber (Liquid Silicone Rubbe, referred to as LSR) is the use of transition metal complexes (platinum, nickel, rhodium, etc.) as a catalyst to form a bridge between Si-H and Si-CH = CH2 to obtain silicon A new type of silicone rubber with rubber elastomers.

In the early 1970s, foreign countries began to study liquid silicone rubber that meets the injection molding process. However, due to the immature technology in all aspects, it can only be suitable for the extrusion molding process. The 1980s was a period of slow development of liquid silicone rubber. There were several major technical problems that have been difficult to solve. First, the contradiction of ensuring good fluidity and high strength; second, how to ensure that there is sufficient operation time after mixing without materials. The third is the limitation of mold design level.

In the 1990s, it was an era of great development of liquid silicone rubber. First, a large number of MQ silicone rubbers were used to solve the contradiction between the fluidity and strength of silicone rubber. Second, the technology of crosslinking inhibitors was also continuously improved. The development of the addition product of acetylene alcohol and SiH-containing polysiloxane has also made great progress in platinum microcapsule technology. Third, the cold flow module technology of mold design has also smoothed the way for liquid silicone rubber in technology.

After the 1990s, the varieties of silicone rubber began to diversify. At present, almost all varieties of high-temperature silicone rubber, liquid silicone rubber, and its performance is better than room temperature vulcanized silicone rubber (HTV). This widens the space for the application of liquid silicone rubber.

For now, the main manufacturers of liquid silicone rubber in the international market are Dow Corning (GE), GE (acquired by Meitu), Shin-Etsu (Japan), WACKER (Germany), Rhodia (Rhodia) Silicone Company, etc., domestic manufacturers mainly include Chengdu Chenhua and Shenzhen Senri.

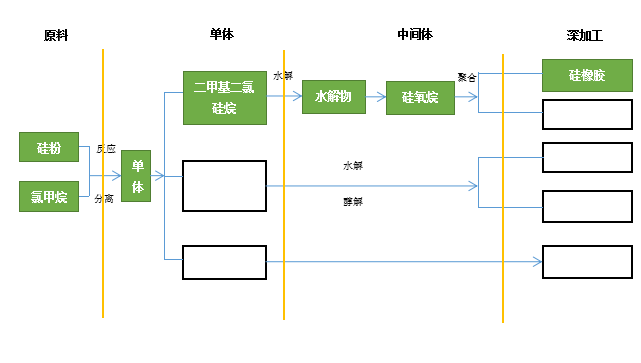

In 1941, GE Corporation of the United States directly synthesized methyl chlorosilane. In the same year, Dow Corning (Dow Corning) Company built the first methyl chlorosilane device, which opened the prelude to the silicone industry. Silicone has excellent properties such as high and low temperature resistance, moisture resistance, weathering resistance, physiological inertness, etc. Silicone products are closely related to various fields of the national economy and play an increasingly important role in the development of high-tech industries and the optimization and upgrading of industrial structure. Electronic and electrical appliances, construction, medicine, daily chemical industry, petroleum, light industry, metallurgy, machinery, textile and other fields are industries that occupy an important position in national economy and people's livelihood. The silicone product chain can be divided into four links: raw materials, monomers, intermediates, products and products. The organic silicon industry chain is shown below:

Figure 1 Silicone industry chain

In the upstream of the organic silicon product industry chain, silicon powder and methyl chloride are used as raw materials to synthesize dimethyldichlorosilane and other most industrially valuable organic silicon monomers. The production process of organic silicon monomers is long and technically difficult. It is a technology-intensive and capital-intensive industry, and its production level and device scale are an important basis for measuring the level of silicone technology in a country. Silicone monomers are made into silicone material intermediates represented by siloxane through processes such as hydrolysis and cracking. The intermediates are further synthesized to obtain silicone oil, silicone rubber, silicone resin, and silane coupling agent. product. Among the four types of deep-processed silicone products, the output of silicone rubber is the largest, accounting for 60 to 70% of the composition of silicone products.

From the perspective of the development trend of downstream application industries of silicone deep processing products, with the global coal and petroleum resources decreasing, the trend of silicone products replacing traditional petrochemicals has become more and more obvious. Its application fields are in addition to construction, power, machinery In addition to the traditional fields of processing, textiles, leather, daily necessities, personal care products, medicine, etc., in recent years, the applications in solar energy, wind power, high-speed rail, automobiles, electronic information technology, medical and health, high-end manufacturing, energy saving and environmental protection have also been expanding.

Table 1 List of liquid silicone rubber applications

| Serial number | Application | Features used | Main application range |

| 1 | Construction industry | Aging resistance, coloring, adhesion | Used as a sealant for road joints; sealing of joints between panels, curtain walls and interior walls of high-rise buildings; filling of gaps around kitchen tiles and sealing around bathtubs, buckets, urinals, etc. |

| 2 | Electronics and electrical industry | Resistant to fatigue, high temperature, weather, and ozone | Keys for computers, telephones, fax machines, and keyboards for various electrical appliances; insulators will replace ceramic products for power transmission lines; television anode covers, high-voltage protective covers, high-voltage lead-out wires, etc |

| 3 | Auto industry | High temperature resistance, fatigue resistance, adhesion | Car ignition wire, spark plug protective cover, heating and radiator hose, muffler lining, fuel pump, oil inlet valve, etc .; on-site formed gaskets, car windshields, door and window frames, reflector lamps, exhaust pipes and water-susceptible Adhesive sealing of shower equipment. |

| 4 | Medical hygiene | Non-toxic, physiologically inert and resistant to aging | Baby pacifiers, various medical hoses, cannulas, cosmetic repairs, artificial organs, drug capsule contact lenses and artificial cornea, dental impression materials, anti-noise earplugs, etc. |

| 5 | Cable industry | Electrical insulation, weather resistance, moisture resistance | Cables made of insulated high-temperature silicone rubber include power cables, ship cables, aviation wires, ignition cables, heating cables, atomic energy cables, etc. |

| 6 | Aviation industry | High and low temperature resistance, ozone resistance, fatigue resistance, radiation resistance | Used as various hoses, oxygen masks, sealing gaskets, cushioning shockproof layers, switch jackets, etc. for aircraft and spacecraft. |

| 7 | other aspects | Selectively breathable, non-stick, and water vapor resistant | Sealing and bonding of breathable films, solar photovoltaic panels, sealing of frames, sealing and bonding of wind energy generator threads and sealing and sealing of stator slots; flat seals of fan gearboxes, high-pressure cooker sealing rings, hoses, rubber strips, rubber rollers, and adhesive tapes Wait |

2. The correlation between the industry and the upstream and downstream industries

(1) Main upstream and downstream industries

Table 2 Industry upstream and downstream industry table

| Upstream industry | The industry | Downstream industry |

| Silicone monomer | Liquid silicone rubber | Electronic appliances, construction, office equipment, transportation, medicine, food Product processing, daily chemical industry, etc. |

The industrial chain of the silicone rubber industry mainly includes suppliers of raw materials (siloxanes), silicone processing manufacturers, and customers in the new materials industry. The upstream of the industry is a supplier of silicone raw materials, producing silicone monomers, mainly methyl chlorosilane (abbreviated as methyl monomer), phenyl chlorosilane, etc.

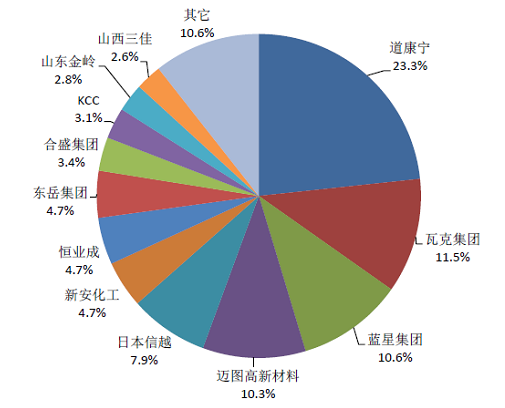

The main producers of polysiloxanes are Dow Corning (capacity: 563,000 tons / year), Wacker Chemical (production capacity: 277,000 tons / year), China Bluestar (capacity: 255,000 tons / year), and Meitu Advanced Materials (USA) Momentive, with a production capacity of 248,000 tons / year), Japan ’s Shin-Etsu (with a production capacity of 190,000 tons / year), and China ’s Xin’an (with a production capacity of 113,000 tons / year). In 2014, the total production capacity of these six companies was 1.646 million tons per year, accounting for 68.2% of the total global production capacity. In 2014, there were 15 Chinese silicone monomer production enterprises, with a total production capacity of 1.135 million tons / year (silicone-converted), and an output of 702,000 tons (silicone-converted). Capacity and output increased by 14.0% and 9.5%. The world's major silicone production capacity and distribution statistics in 2014 are shown in the figure below:

Figure 2 2014 major siloxane production capacity and distribution in the world

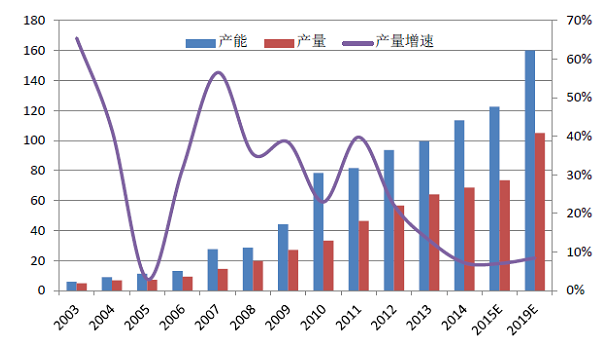

The statistics and forecast of China's methyl monomer production capacity and output from 2002 to 2014 are as follows:

Figure 3 World's major silicone production capacity and distribution in 2014

(2) Association between industry and upstream and downstream industries

As far as the entire silicone industry is concerned, the correlation with the upstream industry is low, and the main impact of the upstream industry is reflected in changes in the procurement costs of the industry. On the whole, the upstream industry is basically a competitive industry, and changes in the upstream industry's production capacity and demand have little impact on the development of the silicone industry itself, and do not play a decisive role in the product cost structure. With the continuous development of the domestic upstream industry, at present, most of the raw materials required by the silicone industry can be adequately supplied from China. The downstream industry has a greater traction and driving effect on the development of the silicone industry, and changes in downstream demand directly determine the future development of the silicone industry.

3. Development status and development trend of silicone industry

(1) Industry development status

The application fields of silicone products are extremely wide. The output of a single brand of silicone products under each gate category is relatively small, and the users are also scattered. This has formed the industry characteristics of centralized monomer production and downstream distributed processing. Take Dow Corning, the world ’s largest silicone company, as an example, none of its silicone business products or customers account for more than 3% of its sales, while several of the country ’s largest silicone producers such as Hongdaxin There are no products or customers in the silicone business such as materials, Tianhui New Materials and Tianci Materials that account for more than 5% of their sales. This characteristic determines that the technical service of the silicone industry is very strong, and the company's operation is constantly developing new products based on customer needs. After the formation of a new market, companies and customers tend to form a relatively stable connection, thereby forming new barriers to technology application. Due to the difficulty of researching and developing high-end silicone products and high technical barriers, the industry boom is longer than that of the general industry.

(2) Industrial integration

At present, all major silicone manufacturers in the world adopt the integrated upstream and downstream production mode, that is, they are engaged in the large-scale production of silicone monomers while producing silicone oil, silicone rubber and other silicone deep-processing products. There are only a few domestic companies such as Xingxin Materials, Xin'an Chemicals, Hongda New Materials, etc. forming a complete industrial chain. For the domestic silicone industry, silicone monomer production enterprises extend to downstream silicone products and silicone product production enterprises. Extension to the upstream silicone monomer is the development trend of the industry.

(3) Increased industry concentration

With the fluctuation of demand caused by the adjustment of industrial structure, the concentration and transfer of production capacity due to market competition, and the reduction of production due to safety and environmental protection factors, the production of individual siloxane finished products has shown a clear trend of concentration to leading enterprises, and the growth rate of production capacity Significantly slowed down, the number of enterprises showed a general trend of reduction, equipment large-scale and automation level increased.

According to different downstream industries, the silicone oil industry is currently affected by the sluggish demand of the textile industry and the impact of the silicone oil safety storm in the daily chemical industry. . The market demand for liquid adhesives is fragmented but growing rapidly, and many small and medium-sized enterprises are emerging in southern and eastern China, with strong production. After years of development, the high-temperature adhesive and liquid adhesive markets have emerged as leading enterprises, and the competition for market dominance among leading enterprises is intensifying. A large number of small and medium-sized enterprises are gradually marginalized due to cost and quality reasons.

4. Market size of the industry

Silicone is a new type of polymer synthetic material. Because of its high and low temperature resistance, weathering resistance, electrical insulation, physiological inertness and other characteristics, it is widely used in many process fields and occupies an important industrial position in national economy and people's livelihood. Silicone rubber is a deep-processed product using silicone as a raw material, and is also the deep-processed product with the largest output at present, accounting for 60-70% of the deep-processed products of silicone. The consumption level of silicone products is closely related to the level of economic development. The United States is the world's largest consumer of silicone products, accounting for about 35% of the global silicone product market, followed by Europe, about 33%, and Japan accounting for about 15%. Due to the difference in industrial structure, there are certain differences in the consumption structure of silicones in countries around the world. Although the silicone rubber market in developed countries is relatively mature, with the continuous development of new uses, the future consumption of silicone rubber will still grow at a rapid rate.

(1) World silicone production

The latest report released by MarketsandMarkets, the world's second largest consulting company, shows that from 2015 to 2020, the compound annual growth rate of the global silicone market will reach 6%. By 2020, the global silicone market value will exceed US $ 20 billion.

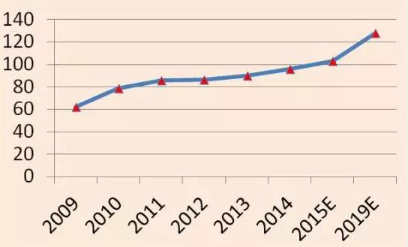

Figure 4 World silicone rubber production (calculated by pure siloxane) Unit: 10,000 tons

In 2014, global polysiloxane consumption was about 1.7 million tons, of which silicone oil, silicone rubber, and silicone resin accounted for 40%, 56%, and 4%, respectively. Silicone rubber consumption is still far ahead.

(2) Production of silicone in China

The development of China's silicone rubber is relatively mature, the market demand is large, and the development speed is also relatively fast. While silicone oil has maintained a relatively stable development rate, production and consumption have increased year by year, and the slowdown in the growth rate of the textile industry has affected the consumption rate of silicone oil to some extent. Silicone products, especially high-quality silicone resin products, are in short supply, and their applications are constantly being explored. The production statistics of major polysiloxane products in China in 2014 are shown in the table below:

Table 3 Production Statistics of Major Polysiloxane Products in 2014 (Physical Quantity)

Unit: 10,000 tons / year, 10,000 tons

| Name | Production capacity | Yield | Operating rate(%) |

| High temperature vulcanized silicone rubber | 55.6 | 36.6 | 65.8 |

| Room temperature vulcanized silicone rubber | 76.7 | 48.0 | 62.6 |

| Liquid silicone rubber | 4.6 | 2.3 | 50.5 |

| Silicone oil | 22.5 | 19.8 | 74.8 |

| Silicone and others | 4.0 | 3.2 | 80.0 |

According to the product status, silicone rubber can be divided into two categories: solid silicone rubber and liquid silicone rubber. Among the two types of silicone rubber, liquid silicone rubber has obvious advantages over solid silicone rubber, such as low energy consumption, high work efficiency, good physical and electrical properties, small production site, and can be constructed on site. Liquid silicone rubber is gradually replacing solid silicone rubber as the leading product of silicone rubber in many application fields. Liquid silicone rubber has a wide range of applications, product performance is superior to solid silicone rubber products, and the market prospect is broad. At present, the global annual production of liquid silicone rubber is about 100,000 tons, and the annual growth rate is not less than 10%. The annual consumption of liquid silicone rubber in China has grown from 3,000 tons in 2003 to 20,000 tons in 2014. In recent years, the average annual growth rate of China's demand for liquid silicone rubber has been maintained at a relatively high level and has become The most important consumer market. With the transfer of some high-end silicone rubber products to China, the demand for high-end silicone rubber in China will grow rapidly at a rate of 30% in the next three to five years.

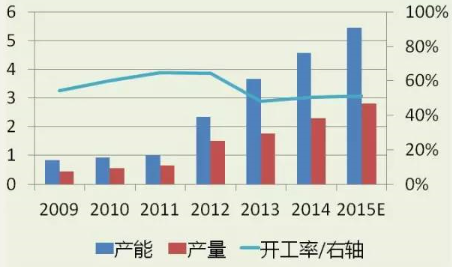

Figure 5 China's LSR capacity, output and operating rate from 2009 to 2014 Unit: 10,000 tons

There are nearly ten liquid glue manufacturers in China, but the scale is not large. Larger companies such as Senri Materials and Guangdong Polymer, and other relatively strong companies have also gradually entered the field of liquid silicone rubber, such as Xinan Chemical and Jiangsu Hongda. Although liquid silicone rubber started late, it is the fastest-growing product in the field of silicone rubber. According to SAGSI research estimates, in 2013, China's liquid glue production capacity was approximately 36,700 tons, and output was approximately 17,700 tons. Capacity and output increased by 56.2% and 17.2% year-on-year. From 2009 to 2014, China's LSR capacity, output and operating rate are as shown above. The main manufacturers are as follows:

Table 4 China's major liquid glue manufacturers in 2014

| Serial number | The company |

| 1 | Mori materials |

| 2 | Guangdong Polymer |

| 3 | Dow Corning (Zhangjiagang) |

| 4 | Jiangxi Spark |

| 5 | Xinan Chemical |

| 6 | Dongguan New Oriental |

| 7 | Anhui Yuhong |

| 8 | Guangdong Biaomei |

| 9 | Shin-Etsu Silicone (Nantong) |

| 10 | Other |

(3) Status of consumption of silicone products in China

Table 5 2006-2014 China's polysiloxane consumption growth and forecast

Unit: 10,000 tons

| Years | Consumption | Gap | Demand growth rate | Self-sufficiency |

| 2006 | 25.7 | 13.7 | 15.3 | 46.7 |

| 2007 | 30.8 | 15.8 | 19.9 | 48.7 |

| 2008 | 36.3 | 14.3 | 18.0 | 60.6 |

| 2009 | 40.0 | 13.0 | 10.2 | 67.5 |

| 2010 | 47.1 | 13.9 | 17.8 | 70.5 |

| 2011 | 56.0 | 9.6 | 18.9 | 82.8 |

| 2012 | 61.8 | 5.1 | 10.7 | 91.7 |

| 2013 | 68.7 | 4.6 | 11.0 | 93.3 |

| 2014 | 72.5 | 1.3 | 5.5 | 98.2 |

| 2015E | 76.0 | 0.0 | 4.8 | 100.0 |

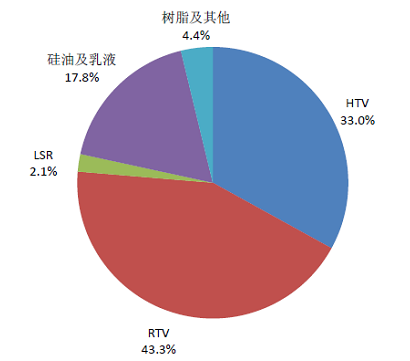

Since 2012, affected by the global economic downturn and the adjustment of China's industrial structure, the growth rate of China's polysiloxane consumption has dropped significantly, and the market structure has changed significantly. According to SAGSI statistics, in 2014, China's polysiloxane consumption was about 725,000 tons, a year-on-year increase of 5.5%, the lowest growth rate in recent years. Among them, high-temperature silicone rubber, room temperature rubber, liquid silicone rubber, silicone oil, silicone resin and other fields accounted for about 31.7%, 33.3%, 2.0%, 7.3%, 4.4% of the total consumption of polysiloxane.

Figure 6 Proportion of Chinese polysiloxane consumption in various fields in 2014

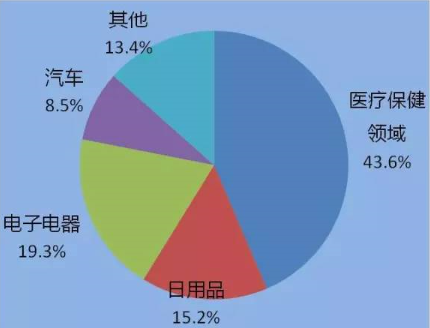

Liquid rubber is a type of silicone rubber that has developed rapidly in recent years, has a high grade, a large product technical content, and has high added value. Compared with room temperature rubber, it has no by-products during the vulcanization process and a small shrinkage rate. 3. The advantages of deep vulcanization, the sealing performance at high temperature is also better than room temperature adhesive. Its relative viscosity is low, especially when manufacturing small products. Numerous advantages make it widely used in automobiles, electronic appliances, medical care, and mechanical engineering.

Figure 7 China's LSR consumption in various fields in 2014

Thanks to the improvement and innovation of materials, equipment and processes, LSR gradually got rid of the current situation of niche demand and expanded the application field. At present, LSR is mainly used in pregnancy and infant supplies, medical care, electronics, etc. In recent years, China's LSR glue demand and 2013 demand forecast are shown in the table below

Table 6 China's LSR demand from 2006 to 2013

| Years | 2009 | 2010 | 2011 | 2012 | 2013 |

| Consumption(%) | 1.2 | 1.4 | 1.5 | 1.65 | 1.94 |

| Gap (10,000 tons) | 0.75 | 0.85 | 0.85 | 0.14 | 0.17 |

(4) Import and export volume of liquid silicone rubber products

In 2013, China imported about 5,030 tons of liquid silicone rubber, down 20.5% year-on-year; exported about 3,330 tons of liquid silicone rubber, down 32.3% year-on-year; the market gap was about 1,700 tons. In 2013, China's monthly export volume of liquid silicone rubber remained above 200 tons, an increase from 2012. In February, due to the Spring Festival, the export volume was low. In 2013, China ’s liquid silicone rubber exports were mainly for Hong Kong, Thailand, the United States, India, Turkey, Taiwan, and other countries and regions. Customs declarations were made through Gongbei Customs, Shenzhen Customs, Shanghai Customs, Nanjing Customs, Huangpu Customs, and other customs. Customs export declarations The volume accounts for 32%, 28%, 18%, 11%, and 7% of the total export volume, respectively. In 2013, China's major LSR export companies include: Guangdong Polymer Silicone Material Co., Ltd., Shenzhen Senri Silicone Material Co., Ltd., Maitu High-tech Materials (Nantong) Co., Ltd., Dow Corning (China) Investment Co., Ltd., and Dongguan Baoshun Silicone Products Co., Ltd. and other LSR production and trading enterprises.

In 2013, China's imports of liquid glue mainly came from Japan, Germany, Taiwan, France, Thailand, the United States and other countries and regions, which were more scattered. In 2013, China ’s imports of liquid silicone rubber mainly passed through Huangpu Customs, Shanghai Customs, Shenzhen Customs, Fuzhou Customs, Tianjin Customs, Qingdao Customs and other customs, each of which accounted for 45%, 25%, 10%, 6%, 5 of the total imports. % And 3%. In 2013, China's major LSR importers include Dongguan Jiexun Rubber Co., Ltd., Bluestar Silicone (Shanghai) Co., Ltd., Fuqing Zhaohe Precision Electronics Co., Ltd., Dongguan Zhongyi Silicone Products Co., Ltd., Dow Corning (China) Investment Co., Ltd., and Ara Rubber Products Co., Ltd., Dongguan Yashi Electronics Co., Ltd., Wacker Chemicals (China) Co., Ltd. and other rubber products and trading enterprises.

Li Juan, Guolian Securities